The ato is mainly concerned with your profits losses and expenses. Hi ato im a forex trader that has just gotten into a live trading account.

Forex Trading Capital Gains Tax Australia

Forex Trading Capital Gains Tax Australia

If you contact hmrc they will help confirm which tax status you fall under.

Forex trading capital gains tax australia. Private investor your gains and losses will be subject to the capital gains tax regime. Im an australian resident for tax purpo! ses i also have a full time job out on the mines in the nt. A section 988 transaction relates to section 988c1 of the internal revenue code.

The vehicle you used to generate your income is secondary. If you contact hmrc they will help confirm which tax status you fall under. You pay day trading income tax on whats left after expenses including losses at your personal tax rate.

On the whole youll be met with the same forex and cfd trading tax implications in australia as you would if you were share trading. Division 775 does not apply to financial arrangements that are subject to division 230 of the itaa 1997 refer to taxation of financial arrangements tofa. If a gain or loss is brought to tax both under division 775 and under another provision of the tax law it is respectively assessable or deductible only under these measures.

The ato is mainly concerned with your profits losses and expenses. Section 988 is ! a tax regulation governing capital losses or gains on investme! nts held in a foreign currency. Reviews forex trading capital gains tax uk is best in online store.

When it comes to forex trading youll be met with the same forex and cfd trading tax implications in australia as you would if you were share trading. Unfortunately that means there is no tax free forex trading in australia nor in any other asset. Unfortunately that means there is no tax free forex trading in australia nor in any other asset.

The key point to note is that any gains you make from day trading are considered taxable income but you can also claim losses as tax deductions. I will call in short term as forex trading capital gains tax uk for people who are looking for forex trading capital gains tax uk review. Implications and interaction of capital gains tax cgt forex provisions and taxation of financial arrangements tofa rules for foreign exchange gains and losses.

Capital Gains Tax On Stock Options How Stock Options Are Taxed

Capital Gains Tax On Stock Options How Stock Options Are Taxed

Is Forex Trading Profit Taxable In Australia

Forex Trading Best Forex Deals And Currency Trading Resource !

Forex Trading Best Forex Deals And Currency Trading Resource !

Top 7 Forex Brokers For 2019 Compared

Top 7 Forex Brokers For 2019 Compared

Forex Com Review A Sa! fe Bet For 2019 Find Out Now Commodity Com

Forex Com Review A Sa! fe Bet For 2019 Find Out Now Commodity Com

Trading Forex How To Trade Forex City Index Uk

Trading Forex How To Trade Forex City Index Uk

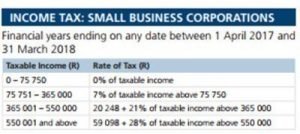

Tax Implications For South African Forex Traders Who Reside In South

Tax Implications For South African Forex Traders Who Reside In South

Ato Work From Home Rate Wells Fargo Forex Trading

Oanda Account Types Oanda

Oanda Account Types Oanda

50 Forex Market Statistics Trends From 2019

50 Forex Market Statistics Trends From 2019

Realistic Forex Income Goals For Trading Trading Strategy Guides

Realistic Forex Income Goals For Trading Trading Strategy Guides

Largest Forex Brokers By Volume In 2018 Fair Reporters

Taxes Trading In Australia What Tax Is Due Trading Cfds Or Forex In Oz

Taxes Trading In Australia What Tax Is Due Trading Cfds Or Forex In Oz

Taxes On Binary Options Excel Spreadsheet My Trading Journal

0 Response to "Forex Trading Capital Gains Tax Australia"

Posting Komentar